All Categories

Featured

Table of Contents

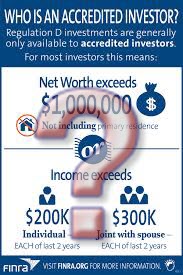

A specific need to have a web well worth over $1 million, excluding the primary house (independently or with spouse or companion), to certify as a recognized capitalist. Demonstrating adequate education and learning or work experience, being a registered broker or financial investment consultant, or having particular expert qualifications can additionally certify an individual as a certified capitalist.

Recognized investors have accessibility to financial investments not signed up with the SEC and can include a "spousal equivalent" when determining qualification. Approved financiers may face potential losses from riskier financial investments and must confirm financial sophistication to take part in unregulated investments (definition of accredited investor). Accredited financier condition issues due to the fact that it determines qualification for financial investment opportunities not readily available to the public, such as personal positionings, financial backing, hedge funds, and angel financial investments

Investments For Non Accredited Investors

To participate, recognized investors have to come close to the provider of unregistered protections, who might require them to finish a questionnaire and supply monetary records, such as income tax return, W-2 types, and account statements, to verify their condition. Laws for certified investors are looked after by the united state Securities and Exchange Compensation (SEC), making certain that they fulfill details financial and specialist standards.

This expansion of the certified financier swimming pool is intended to preserve investor defense while offering better accessibility to non listed financial investments for those with the required financial sophistication and danger resistance. - are you an accredited investor

Accredited Investor Income

Realty submission is somewhat comparable to REITs because it likewise entails pooling resources to buy property financial investments. A syndication deal is when multiple capitalists pool their sources with each other to buy a solitary realty residential property. This deal is placed together by a syndicator, additionally called the basic enroller.

These investors will certainly offer many of the capital needed to obtain the home. The difference with REITs is that you can pick what submission deals to take part in. If you believe in the real estate residential property being syndicated, you can sign up with as one of the passive capitalists. Real estate submission can be done with any sort of property, however multifamily syndication is one of the most preferred kind because multifamily properties frequently generate a lot of constant revenue.

These residential or commercial properties produce consistent cash money circulation through monthly rental earnings. Additionally, these huge homes are typically more challenging to get as an only capitalist, which is why submission is an optimal setup. Financiers can take part in multifamily property investing with a much lower minimal investment. The syndicator will additionally be in cost of residential property management, indicating easy capitalists do not have to fret about ending up being a property manager.

Accredited financiers do not have to gather rental earnings, offer with renters, manage emergencies, spend cash on fixings, and so on. Either the syndicator will certainly hire a 3rd party residential or commercial property manager to do this or they will certainly handle it themselves.

This means capitalists get easy earnings from rental fees, and the ultimate structure sales. This is based on what percent of the building they own, depending on the bargain structure.

Verify Accredited Investor

:max_bytes(150000):strip_icc()/accreditedinvestor_final-f821797e377f4f5aaf1310f1f47d181d.jpg)

Our opinions are our own. An approved investor is a person or establishment that can spend in unregulated safeties.

Unregistered safety and securities are inherently risky yet usually provide greater rates of return. If you've ever stumbled upon a financial investment readily available only to so-called recognized investors, you have actually likely wondered what the term indicated. The label can relate to entities varying from massive financial organizations and affluent Lot of money 500 companies, all the method down to high-earning houses and also people.

, providing market access to smaller sized business that may otherwise be crushed under the expenses accompanying SEC registration.

They can also collect riches, acquisition actual estate, develop retirement portfolios, take dangers, and gain rewards the most significant distinction is in the range of these endeavors., and angel investing.

As an example, the SEC thinks about hedge funds a much more "flexible" financial investment method than something like shared funds, because hedge funds make use of speculative practices like utilize and brief selling. Since these complicated products call for added research and understanding, capitalists need to demonstrate that they understand the dangers associated with these kinds of financial investments prior to the SEC is comfy with them diving in

While lots of are primarily acquainted with the SEC's customer security efforts, the governing authority's commitments are actually twofold. To guarantee that those two efforts aren't in conflict, it's in some cases necessary for the SEC to match up high-risk, high-reward possibilities with suitable capitalists.

Accredited Investor Requirements Sec

One helps navigate the uncontrolled market, and the various other will certainly drift you to safety and security need to the waves intimidate. The average financier is safe on the coastline or paddling in the shallows, risk-free under the watchful look of the lifeguard (i.e., the SEC). Safety and securities that are readily available to recognized capitalists are provided through personal offerings, which may come with less regulations than securities used to more regular capitalists.

By Percent - January 11, 2021 When it comes to purchasing stocks and bonds, virtually any individual can spend. As long as you're over the age of 18 (or 21, in some states), not trading on details, or not spending as part of a problem of passion, you can be a part of public markets whether you have $1 or $1 million.

Specific investment vehicles consisting of those on Percent are only readily available to a course of financiers legally specified as These capitalists have the specific authorization from governing bodies based upon a slim collection of requirements to buy certain kinds of financial investments secretive markets. Yet that can be a recognized capitalist? Even better, why are certified investors a point in the first place? After the Great Depression, the united state

This act needed financiers to have a better understanding of what they were spending in, while forbiding misstatements, fraud, and fraud in protection sales. Congress presumed this regulation would protect the "routine" financier. Exclusive offerings those beyond the public stock market were excluded from securities regulations, which produced some issues.

The Stocks and Exchange Compensation (SEC) ultimately took on regulation 501 of Law D, which defined who might purchase exclusive offerings and defined the term "certified financier" a term that was later on upgraded in 2020. A certified investor is any person who fulfills any of the complying with standards: Financiers with gained revenue that went beyond $200,000 (or $300,000 with each other with a partner) in each of the previous two years, and anticipates to meet the exact same benchmarks in the existing year.

Those who are "well-informed employees" of an exclusive fund. SEC- and state-registered investment advisors (however not reporting consultants) of these entities can also now be thought about accredited investors.

Accredited Investor Leads Oil Gas

If you have a web well worth of over $1 million (not including your main property/residence), made $200,000+ a year for the last two years, or have your Collection 7 certificate, you can make investments as a certified investments. There are numerous other certifications (as you can find over), and the SEC intend on including a lot more in the close to future.

Given that the early 1930s, federal government regulatory authorities have discovered it tough to protect financiers secretive offerings and protections while at the same time sustaining the development of start-ups and other young companies - business that many believe are in charge of the majority of job development in the USA - qualified purchaser definition. Stabilizing this job had been center of the mind of the Stocks and Exchange Commission ("SEC") for many years

Latest Posts

Delinquent Tax Sales

Delinquent Property Tax Auction

Tax Overages Blueprint